Page 38 - Q&A Book.indd

P. 38

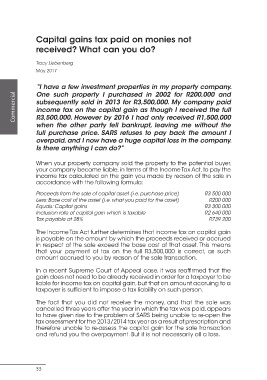

Capital gains tax paid on monies not

received? What can you do?

Tracy Liebenberg

May 2017

“I have a few investment properties in my property company.

One such property I purchased in 2002 for R200,000 and

Commercial subsequently sold in 2013 for R3,500,000. My company paid

income tax on the capital gain as though I received the full

R3,500,000. However by 2016 I had only received R1,500,000

when the other party fell bankrupt, leaving me without the

full purchase price. SARS refuses to pay back the amount I

overpaid, and I now have a huge capital loss in the company.

Is there anything I can do?”

When your property company sold the property to the potential buyer,

your company became liable, in terms of the Income Tax Act, to pay the

income tax calculated on the gain you made by reason of the sale in

accordance with the following formula:

Proceeds from the sale of capital asset (i.e. purchase price) R3 500 000

Less: Base cost of the asset (i.e. what you paid for the asset) R200 000

Equals: Capital gains R3 300 000

Inclusion rate of capital gain which is taxable R2 640 000

Tax payable at 28% R739 200

The Income Tax Act further determines that income tax on capital gain

is payable on the amount by which the proceeds received or accrued

in respect of the sale exceed the base cost of that asset. This means

that your payment of tax on the full R3,500,000 is correct, as such

amount accrued to you by reason of the sale transaction.

In a recent Supreme Court of Appeal case, it was reaffirmed that the

gain does not need to be already received in order for a taxpayer to be

liable for income tax on capital gain, but that an amount accruing to a

taxpayer is sufficient to impose a tax liability on such person.

The fact that you did not receive the money, and that the sale was

cancelled three years after the year in which the tax was paid, appears

to have given rise to the problem of SARS being unable to re-open the

tax assessment for the 2013/2014 tax year as a result of prescription and

therefore unable to re-assess the capital gain for the sale transaction

and refund you the overpayment. But it is not necessarily all a loss.

33